Innovative platform for smart investments

Sign up and get 10,000 USD to your demo account to learn how to trade.

*The minimum deposit amount to start real trading is 10 USD

Why Choose Quotex?

Everything you need for a superior trading experience.

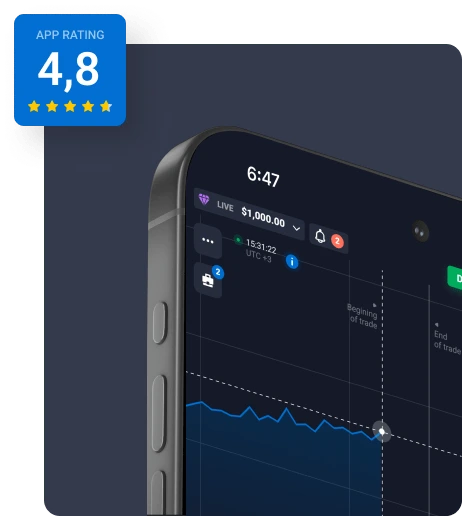

Intuitive Interface

A clean, simple, and powerful trading interface suitable for both beginners and experts.

Instant Execution

Experience lightning-fast trade execution with our cutting-edge technology.

Secure & Reliable

Your funds and data are protected with the highest standards of security.

Global Access

Trade from anywhere in the world. Easy Quotex login access on any device.

24/7 Support

Get assistance whenever you need it with our round-the-clock customer support team.

Diverse Assets

Trade a wide variety of assets including currencies, commodities, and stocks.

Start Trading in a Few Clicks

No complex forms, no delays. Your journey into the financial markets is just moments away.

Grow your capital by making the right trading predictions

Will the price go up or down? Predict the price movement of a trading asset and place a trade.

1. Select an asset

2. Monitor the chart

3. Place a trade

4. Get the result

See The Platform in Action

Discover how easy it is to trade with Quotex.

What Our Traders Say

Real feedback from our global community.

"An amazing platform! The interface is very easy to use and the withdrawal process is fast. Highly recommended for beginners."

Budi Santoso

Indonesia

Account: 5820193

Earned: +$1,250

"The execution speed is incredible. I've tried many platforms, but Quotex is by far the most reliable. The mobile app is fantastic."

John Smith

United States

Account: 7392011

Earned: +$3,400

"I started with the demo account and it helped me learn so much. Now I'm trading with real money and the results have been great."

Maria Garcia

Spain

Account: 6109824

Earned: +$2,180

"A wide range of assets and excellent analytical tools. Quotex provides everything I need for my trading strategy. The platform is stable."

Ken Tanaka

Japan

Account: 8847201

Earned: +$5,600

"Secure, fast, and transparent. I appreciate the low minimum deposit which allowed me to start small. I'm very happy with my experience."

Fatima Al-Sayed

UAE

Account: 4028173

Earned: +$1,950

"The interface is very clean and not cluttered. It's easy to focus on what matters: the charts. Withdrawals are processed within a day."

Lucas Schmidt

Germany

Account: 9123456

Earned: +$4,120

Ready to Start Your Trading Journey?

Create your account in minutes and explore the world of financial markets.

Sign Up for FreeFrequently Asked Questions

How do I perform a Quotex login?

To log in to your Quotex account, simply visit the official website and click the "Login" button. Enter your registered email and password. If you've forgotten your password, you can use the "Forgot Password" link to reset it.

Is Quotex safe for trading?

Yes, Quotex employs advanced security measures, including SSL encryption, to protect user data and funds. The platform is built to be secure and reliable for traders worldwide.

What is the minimum deposit?

Quotex is known for its accessibility, offering a low minimum deposit to help new traders get started. The exact amount can vary by region and payment method, but it is typically around $10 USD.

Can I use a demo account?

Absolutely! Quotex provides a free demo account with replenishable virtual funds. This allows you to practice your trading strategies and get familiar with the platform without risking any real money.

What payment methods are available?

Quotex supports a wide range of payment methods for deposits and withdrawals, including credit/debit cards, e-wallets (like Skrill and Neteller), and cryptocurrencies. The availability may vary depending on your country of residence.

Does Quotex provide trading signals?

Yes, the Quotex platform includes integrated trading signals that provide recommendations based on technical analysis of various assets. These can be a helpful tool, especially for new traders, to analyze the market and find trading opportunities.